Financial Aid & Scholarships

Paying for College

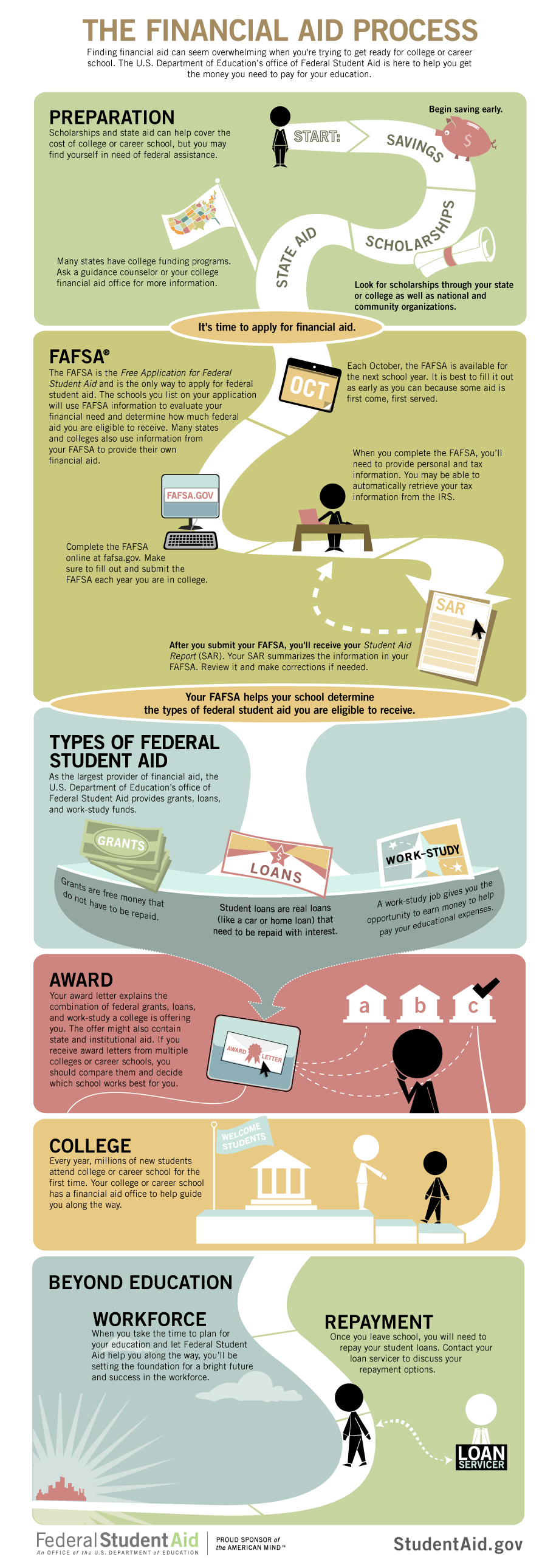

Applying for aid and scholarships at best is confusing and at worst is unworkable. These processes can be time consuming but they are not impossible! Much of the process is know where to start. Each year the U.S. Government gives $120 billion– yes, billion, with a b- in financial aid to students. Be sure to get yours!

Kinds of Financial Aid

First, let’s review some more vocabulary words that can help you through this process. It may seem overwhelming, but there is plenty of support waiting for you!

| Financial Aid | Money given or loaned to you to help pay for college. Financial aid can come from federal and state governments, colleges, and private and social organizations. |

| Need-Based Financial Aid | Financial aid (grants, scholarships, loans and work-study opportunities) given to students because they and their families are not able to pay the full cost of attending a certain college. This is the most common type of financial aid. |

| Scholarship | A kind of “gift aid” — financial aid that doesn’t have to be paid back. Scholarships may be awarded based on merit or partially on merit. That means they’re given to students with certain qualities, such as proven academic or athletic ability. |

| Free Application for Federal Student Aid (FAFSA) | The free application form you submit to apply for federal financial aid. It is required for all students seeking federal student grants, work-study programs and loans. Most colleges require it as well. The FAFSA may also qualify you for state-sponsored financial aid. |

| Work Study | A program that allows students to take a part-time campus job as part of their financial aid package. To qualify for the Federal Work-Study Program, which is funded by the government, you must complete the Free Application for Federal Student Aid (FAFSA). Some colleges have their own work-study programs. |

| Grant | A kind of “gift aid” — financial aid that doesn’t have to be paid back. Grants are usually awarded based on need. |

| Scholarship | A kind of “gift aid” — financial aid that doesn’t have to be paid back. Scholarships may be awarded based on merit or partially on merit. That means they’re given to students with certain qualities, such as proven academic or athletic ability. |

| Loan | Money you borrow from the government, a bank or another source. Loans need to be paid back, usually over an agreed period of time. You will most likely also have to pay interest on a loan — a fee for borrowing the money. |

Here is a great video offering more information about different types of aid that will be available to you:

Great! Now What?

At this point you should start having conversations with your family regarding paying for college. Will they be paying for your education? Will they be paying for all of it? We previously discussed living expenses, what about those? If they are not paying for it, are they willing to co-sign a loan for you? These are big conversations that can be hard, but they have to be had.

To apply for FAFSA, you will need a copy of your parent/ guardian/ human that claims you on their taxes tax return from the previous year. You will also need the social security numbers of your family members, but that will likely be on your tax return. I suggest looking them over and keeping them in a safe spot so you will have access to them.

Additionally, now is a good time to start looking at scholarships. Most scholarships are awarded to juniors and seniors, but if you look at different scholarships, there tends to be overarching themes. If you write one solid essay for a scholarship, there is a good chance you might be able to use it again to apply for another scholarship. Scholarships can be time consuming, but you have to put in the time if you want the money!

How Do I Know If I am Eligible for Aid?

Great question! You don’t. However, there are several sources that you can use to help you get an understanding. For instance, in New York State, there are a number of support programs for students. Below is the eligibility chart. Typically if you meet these guidelines, you will likely receive a good amount of federal aid. You can also use this calculator to get an estimate of your family’s contribution.

| Number of members in Household (Including the Head of Household) | Total Annual Income |

| 1 | $23,606 |

| 2 | $31,894 |

| 3 | $40,182 |

| 4 | $48,470 |

| 5 | $56,758 |

| 6 | $65,046 |

| 7 | $73,334 |

| 8 | $81,622 |

Options for Undocumented Students

Being undocumented does not mean that financial aid is not an option for you! There are lots of resources available to help you apply for financial aid. For more information, I suggest reviewing this tip sheet to help you and your individual needs.

Remixed with:

“Eligibility & Model.” CUNY, https://www.cuny.edu/academics/academic-programs/seek-college-discovery/eligibility/.

“Financial Aid Glossary: Learn the Lingo.” BigFuture, https://bigfuture.collegeboard.org/pay-for-college/financial-aid-101/financial-aid-glossary-learn-the-lingo.

“The Financial Aid Process.” Federal Student Aid, studentaid.gov.

“Types of Federal Student Aid.” YouTube, https://www.youtube.com/watch?v=Pn4OECMTh5w.